NY pot regulators boast $150M in legal cannabis sales as illegal marijuana stores rob state of millions in taxes

From NYPost.com, By Aneeta Bhole, Published Dec. 29, 2023

New York pot regulators bragged Friday about the financial success of the legal cannabis industry in 2023 — but made little mention of the millions in taxes being lost to the illegal marijuana stores spreading across the landscape like weeds.

The Office of Cannabis Management’s year end statement was filled with superlatives describing a blooming industry that brought in some $16.5 million in tax revenue on the sales of some 3.5 million pot products sold.

“2023 was a year of growth for New York cannabis and we know 2024 will be even more significant,” said John Kagia, the office’s Director of Policy, which said there was some $150 million in total legal sales this year.

The office, however, couldn’t put a price tag on how much was being sold at the estimated 1,500 illegal vendors operating on nearly every commercial block in the city and elsewhere in the state — which officials have complained have been stealing business from the measly 40 officially licensed shop currently approved in New York state.

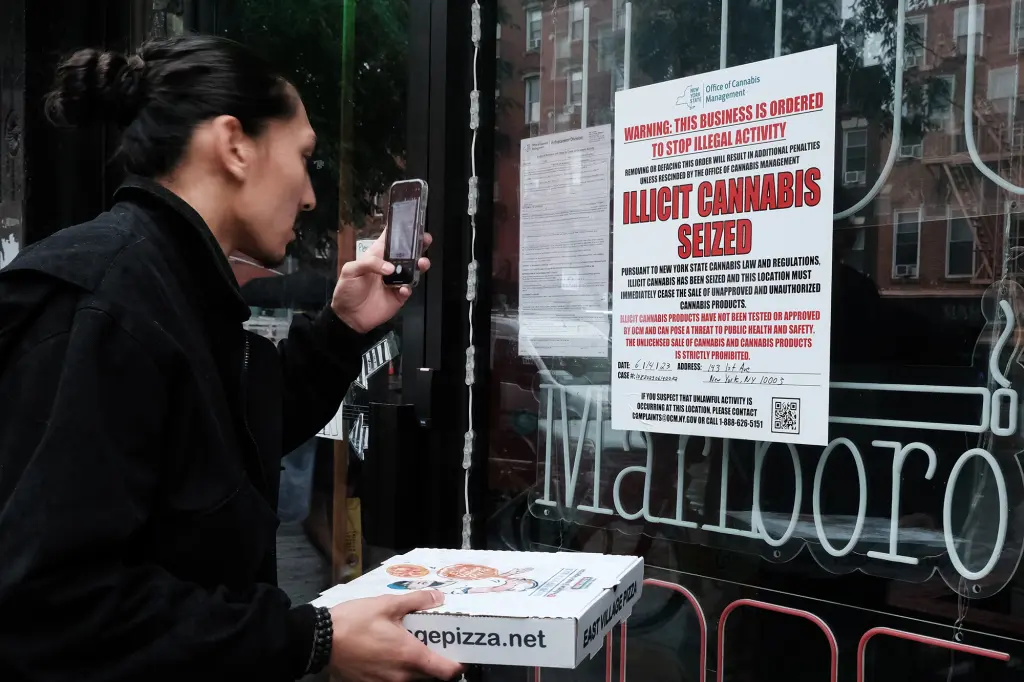

The statement did say that they were cracking down on the illegal shops, and that more than 11,600 pounds of illicit products, with an estimated street value of more than $56 million, has been seized.

NY pot regulators boast $150M in legal cannabis sales as illegal marijuana stores rob state of millions in taxes (Provided by New York Post).

New York pot regulators bragged Friday about the financial success of the legal cannabis industry in 2023 — but made little mention of the millions in taxes being lost to illegal marijuana stores. Helayne Seidman

But when asked for details about the total size of the illegal industry, operating in plain sight, the state could provide no data.

Vendors setting up unlicensed shops mostly do business in cash and don’t pay cannabis taxes that licensed marijuana dispensary stores are required to do.

A spokesperson for the cannabis office said they “do not have firm or reliable estimates on total number of unlicensed shops.”

The Office of Cannabis Management’s year end statement was filled with superlatives describing a blooming industry that brought in some $16.5 million in tax revenue on the sales of some 3.5 million pot products sold (Getty Images).

The state said that close to 7,000 licenses were applied for processors, cultivation, distribution, microbusiness and retail dispensary this year and Kagia noted demand was high and is expected to grow.

“And now, with the Office poised to issue hundreds more adult use retail licenses, there’s tremendous excitement as consumers across the state are poised to gain access to this exciting market,” he said.

Just in New York over 500 strains have been made available to the exploding market with names such as Gas Face, Blueberry Muffin, and Sour Diesel.

2023 was a year of growth for New York cannabis and we know 2024 will be even more significant,” said John Kagia, the office’s Director of Policy, which said there was some $150 million in total legal sales this year (Matthew McDermott).

“There are also products available across the price spectrum, from low-cost value brands to ultra-premium product,” Kagia added.

“Furthermore, it’s not just flower products that are selling. Non-flower products, from infused gummies and innovative beverages like cannabis infused apple cider, to strain-specific vaporizers and high potency tinctures, ensure that there is something for everyone in this market.”

From NYPost.com