New condo sales were slow in Manhattan in March, according to a Marketproof report.

This is reported by Marketproof.com.

Fewer condos sold in Manhattan last month than in February, despite an uptick in the luxury market, while buyers in Brooklyn signed contracts for five more units than last month.

“With [March] demand closely resembling that of the pre-pandemic period, we may see some normalization of the market as mortgage rates stabilize,” said Marketproof CEO Kael Goodman.

Citywide, deal volume rose by 7% month-over-month, continuing an upward trajectory for the fourth month

Total dollar volume rose 18% to $796M, the best month since June of 2023The luxury market saw a 26% increase in deal volume from last month and a 7% increase in dollar volume

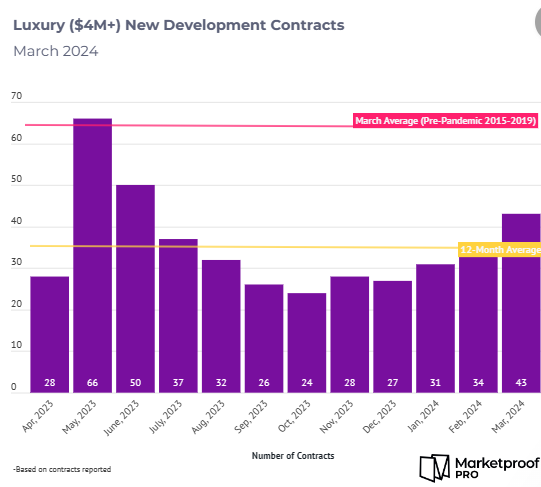

While the March numbers are upbeat, they fall short of the March average during the pandemic recovery (2021-2023) and align more closely with pre-pandemic (2015-2019) numbers

The upward momentum continues for the fourth month, though at a more subdued pace. Deal volume rose 7% from 262 in February to 281 in March. Deal count in Manhattan and Brooklyn was essentially unchanged, but Queens saw an uptick of 57%. The surge in Queens is attributed to a batch of 23 contracts reported at 134-16 35th Avenue. Total dollar volume increased by 18% to $769M from $676M. The median price per square foot (PPSF) dipped slightly from $1,635 to $1,587, and the median price decreased by 7% from $1.62M to $1.5M. The drop in unit price and PPSF reflects a more significant share of the deal volume originating in Queens, a borough with more modestly priced units.

While March’s performance improved month over month, the deal volume represents a 56% decrease compared to the average of 439 deals per month during the pandemic recovery period from 2021 to 2023. The demand in March 2024 aligns more closely with the 289 average during the pre-pandemic period from 2015 to 2019.

Of the 281 deals citywide, 133 (-1%) were in Manhattan, 107 (+5%) were in Brooklyn, and 41 (+57%) were signed in Queens.

LUXURY

The luxury segment saw deal volume jump by 26% month over month, reaching a nine-month peak of 43 contracts. The total dollar volume grew by 42% from $300M to $427M. The median price rose 7% from $5.9M to $6.4M, and the median PPSF was unchanged at $2,631.

One High Line led in deal volume with six contracts over $4M. The West Chelsea complex found buyers for 95 of 235 residences since sales launched a little over a year ago. Corcoran Sunshine Marketing Group handles sales and marketing.

125 Perry Street led in dollar volume with three contracts totaling $112M, or 26% of the luxury market. The West Village boutique has sold 3 of the 7 residences. Compass handles sales and marketing.

Of the 43 luxury deals this month, 40 were in Manhattan, and three were signed in Brooklyn.