Fiorentina Pizza Closes in Midtown

Fiorentina Pizza has closed after a couple of years at 852 8th Avenue. Manhattan Real Estate Tracker has learned that this area has been hit by the reduction in daily workers in Midtown.

Fiorentina Pizza has closed after a couple of years at 852 8th Avenue. Manhattan Real Estate Tracker has learned that this area has been hit by the reduction in daily workers in Midtown.

From the NYPost:

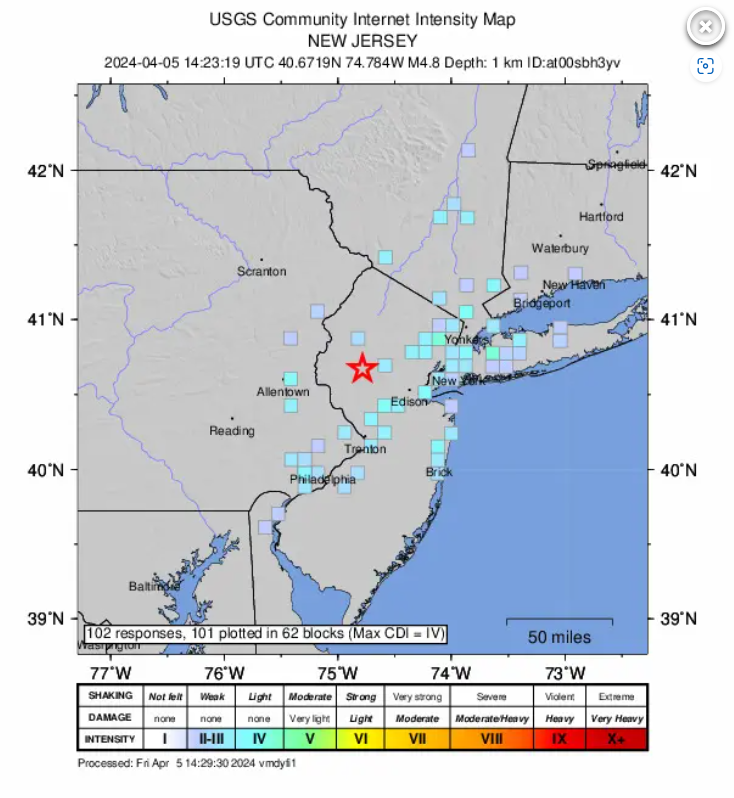

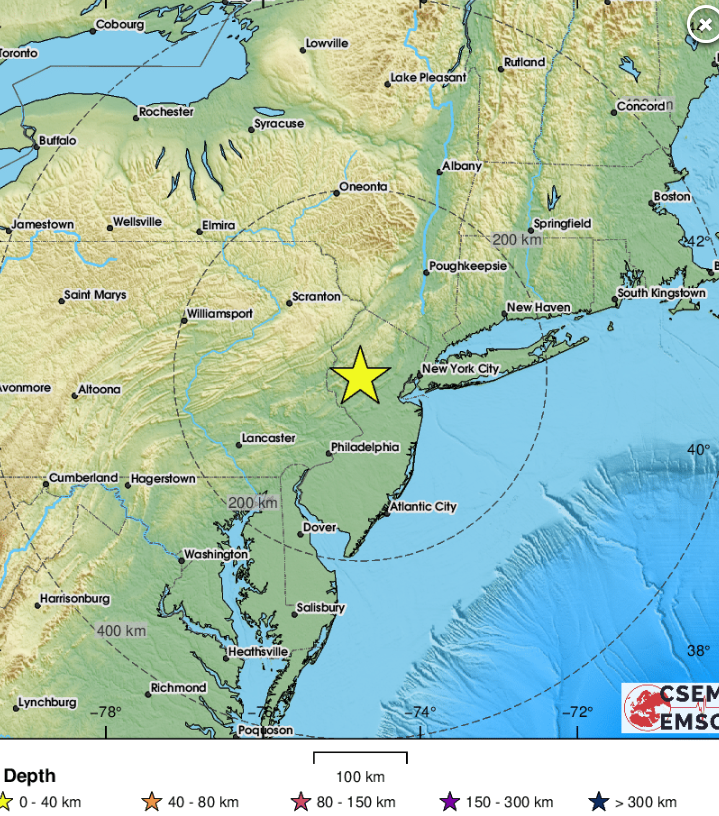

A rare earthquake rocked the New York City area on Friday morning, swaying buildings and sending terrified residents into the streets — as the strongest tremblor to hit the Big Apple in 130 years.

City officials quickly warned people of the danger of potential aftershocks — which already began in the early afternoon in New Jersey, a report said.

The preliminary 4.8-magnitude earthquake struck near Lebanon, NJ, around 10:23 a.m., the first time a major temblor hit the city since 2011.according to the US Geological Survey.

“I was doing my morning reporting, and this safe in my office, that’s a ton, starts shaking. The whole room is shaking,” said Monique Horton, who works at the Balmain store on Madison Avenue in Manhattan. “I was just freaked out. Scary, really scary. I’m a New Yorker, my whole life, 36 years, never seen anything like it.”

At the United Nations in Midtown Manhattan, a Security Council address on the Israel-Gaza conflict was interrupted as cameras began shuddering.

The Federal Aviation Administration told airlines to expect flight delays in and out of the Big Apple because of the quake. Some flights bound for New York had already diverted to other airports, according to FlightAware.

The busy Holland Tunnel, too, was being temporarily shuttered for inspection, the Port Authority of New York and New Jersey said.

Tremors could be felt as far north as New Paltz, New York, and as far south as Delaware.

US Geological Survey figures indicate the quake might have been felt by a staggering 42 million people.

“This is one of the largest earthquakes on the East Coast in the last century,” Gov. Kathy Hochul said.

The last time an earthquake with a magnitude close to, or above, 5 struck near New York City was back in 1884, the USGS said. That quake appeared to have been centered in Brooklyn.

A more minor quake was last felt in the city in 2011 and started in Virginia.

An aftershock Friday occurred in Bedminister, NJ, about two hours after the quake in Lebanon, according to the local Patch.

Both Hochul and Mayor Eric Adams said there were no initial reports of injuries or damage from Friday’s quake, but warned New Yorkers to be wary of possible aftershocks.

“We are always concerned about aftershocks after an earthquake but New Yorkers should go about their normal day,” Hizzoner said.

“Earthquakes don’t happen every day in New York so this can be extremely traumatic. I encourage New Yorkers to check on their loved ones to make sure that they are fine.”

City and state officials said there were no reported infrastructure issues as a result of the quake, noting that all major bridges and tunnels had been inspected.

“At this point… we’ve not identified any life-threatening situations, but we are certainly asking our local law enforcement and emergency services teams to be on guard for that as well,” Hochul said.

“But again, we are going to be reviewing all potentially vulnerable infrastructure sites throughout the state of New York that is critically important in the aftermath of an event like this.”

“It’s been a very unsettling day to say the least,” she said, adding she had been in communication with the White House. “Everyone should continue to take this seriously.”

Still, reports of the quake sparked a flurry of memes and jokes on social media, with the Empire State Building’s official X account jumping into the fray, quipping, “I AM FINE.”

“We survived the NYC earthquake. We will rebuild,” one user wrote alongside a photo of a fallen trash can.

“As New York was hit by an earthquake, I couldn’t help but wonder, were the tecnotic [sic] plates as unstable as my history with Big?” another wrote, riffing off Sex and The City’s Carrie Bradshaw.

“Did we shake or were we shook?” another user posted on X alongside footage of Oprah.

But residents all over the tri-state area — and beyond — were still rattled.

Kelly Shone, a mom of two who works nights in Newark, Del., said she felt a “slight rumbling” while in bed Friday morning.

“I thought it was my husband walking heavily downstairs at first,” Shone told The Post.

“Oh, my God! I jumped and started looking out my windows. That was scary!” said Traci Slade, a 50-year-old mom of two and software insurance employee who felt the quake at her home in Clifton, NJ.

Panicked workers evacuated some buildings in Queens in the aftermath, including paralegal Felicia Alfred, who said, “We thought the building was going to collapse on us.”

From NYPost.com

Story by Justin Lahart, Wall Street Journal

U.S. Economy Added 303,000 Jobs in March© Provided by The Wall Street Journal

U.S. job growth was strong last month, and the unemployment rate fell slightly. But wage growth remained contained, underscoring the growing belief among economists and policymakers that the country can keep adding jobs without fanning inflation.

U.S. employers added a seasonally adjusted 303,000 jobs in March, the Labor Department reported on Friday, significantly more than the 200,000 economists expected. The unemployment rate slipped to 3.8%, versus February’s 3.9%, in line with expectations.

Average hourly earnings in March rose 0.3% from the previous month. That put them up 4.1% from a year earlier, marking the smallest on-the-year gain since June 2021.

Stocks edged up following the report, and Treasury yields moved higher.

Investors have been on edge recently over economic data suggesting that Federal Reserve interest-rate cuts might not be imminent. A stronger-than-expected labor market could feed into those concerns—first because increased spending power for consumers could fuel inflation, and second because a strong labor market gives the central bank more leeway to wait before cutting rates.

The Fed is mandated to keep employment as strong as possible while keeping inflation under control. Balancing those objectives has put the central bank in a difficult position as it mulls cutting interest rates this year: Cut too soon, or by too much, and inflation could heat back up all over again. Wait too long, and the strain of high rates could damage the job market, pushing the economy into a recession.

The labor market has continued to add jobs over the past year despite high interest rates. At the same time, the unemployment rate has drifted up and wage gains have cooled. In March of last year, the unemployment rate was 3.5%.

Those dynamics have defied the conventional wisdom that, for inflation to cool, job creation would need to dramatically slow down.

Lately many economists and even Fed officials have come to believe that, in part as a result of immigration, the supply of available workers has increased. If that is right, the number of jobs can grow faster.

Supply alone isn’t enough to generate job gains, however; there has to be demand. At the moment, it still looks as if there is plenty of that. Layoff activity remains low, and the number of unfilled jobs is high, with the Labor Department reporting earlier this week that there were 8.8 million job openings as of the end of February. The job-opening rate, or openings as a share of filled and unfilled positions, was 5.3%. That has fallen over the past year, but in prepandemic 2019—a period of strength for the job market—that ratio averaged 4.5%.

But the share of people quitting their jobs each month has fallen to prepandemic levels, which indicates that the intensity with which businesses were hiring away workers from each other has subsided. Moreover, the private-sector job market has been drawing most of its strength from just two broad sectors—private education and healthcare, and leisure and hospitality.

Private education and healthcare added 88,000 jobs last month, while leisure and hospitality added 49,000. Combined, the two have accounted for 1.5 million of the 2.9 million jobs the U.S. has gained in the past year.

Economists at Bank of America call those sectors “high touch.” Much of the work must be done in person, and a lot of it—such as waiting tables or working in a hospice—entails face-to-face interactions.

High-touch employment fell sharply when the pandemic hit, and even now, four years later, appears low. Relative to the trend during the five years before the pandemic, there are some two million fewer jobs in those sectors than might have been expected.

This raises a question, points out Bank of America economist Michael Gapen. “Should we expect employment in those sectors to return to their prior trend line? Or are there structural reasons to think maybe the employment gap will not close and therefore this catch-up effect could finish sooner?” he said.

He thinks the answer might be mixed. Lately, employment growth in leisure and hospitality has moderated. One reason why is that for some of those employers, business is still down—think restaurants near offices where many people are still working from home a few days a week. Another is that some businesses adopted practices when labor became short that probably won’t get undone. Lots of restaurants, for example, introduced QR codes in place of paper menus, allowing customers to place orders with their phones rather than waitstaff.

But for private education and healthcare, the story could be different. The loss of jobs these areas experienced when the pandemic hit was truly exceptional: Other than in 2020, employment in the sector has experienced near constant growth over the 85 years of available data. Moreover, the healthcare needs of an aging U.S. population will probably only grow. The sector is still about a million jobs short of its old trend. If that gap continues to narrow, as Gapen expects it will, it could help bolster job growth into next year.

From the WSJ.com

The first Chelsea New York State dispensary has opened recently. Verdi is located at 158 West 23rd Street.

By Hannah Frishberg, NYPost.com

Published April 2, 2024, 10:53 a.m. ET

Manhattan’s offices just hit a new record high for emptiness. VideoFlow – stock.adobe.com

Big Apple office buildings have never been so empty.

While the peak era of remote work may feel long ago in the past, the number of vacant offices in Manhattan just hit a new record.

The borough’s office availability rate -– or, how much of that market is currently unfilled — hit 18.1% in the first quarter of 2024, the highest rate ever recorded. That’s according to a recent report by investment management company Colliers, Crain’s first reported.

In contrast, that number, which includes currently empty offices and those that will be empty in the very near future, was just 10% back in March 2020. The majority of the 8% vacancy increase that has occurred since then happened between 2020 and 2022.

Still, the rate has gone up even in the past 12 months, when it was 17.1%, and even last quarter, when it was 17.9%.

With the increase in availability, rent has also gone down slightly; 0.2% over the course of February.

In terms of leasing, the return to office is not currently going very well, according to the numbers. Pavel – stock.adobe.com

“We are still waiting for demand to catch up and surpass supply,” Colliers Executive Managing Director Franklin Wallach told Crain’s. “It’s still the early innings of 2024, and there are both a fair number of large leases pending and a large number of tenants in the market. But we also anticipate some large blocks of space to be added.”

Downtown is hurting the most, according to Colliers, with the Financial District the most forsaken of commercial markets.

Midtown has fared better, but the biggest divide in which offices will find tenants and which will remain derelict isn’t based on neighborhood, but age and offerings. Newer, more amenity-filled Class A buildings, as they’re called, are getting leased at a significantly faster clip.

For those banking on the death of remote work and the reclaiming of offices, there is one positive angle in Colliers’ findings, Crain’s notes: The rate at which offices are emptying out is, at least, not as fast as it was at the height of COVID-19.

By Hannah Frishberg, NYPost.com

Brooklyn’s tallest building is struggling to pay its skyscraping loans.

Michael Stern, the developer of 9 DeKalb Avenue’s 93-story The Brooklyn Tower, has defaulted on a $240 million mezzanine loan and now faces foreclosure, the Real Deal has reported.

A UCC foreclosure auction has been scheduled for Jun. 10 by Silverstein Capital Partners, which issued the loan in 2019, according to marketing materials from real estate company JLL.

The Brooklyn Tower, a 93-story structure located at 9 DeKalb Avenue, is the tallest building in the borough.

“9 DeKalb’s junior mezzanine, senior mezzanine and mortgage loans are in maturity default, and the junior mezzanine lender is enforcing its junior mezzanine loan remedies through a Uniform Commercial Code (UCC) sale process,” a Silverstein spokesperson confirmed to The Post.

“The junior mezzanine lender has engaged JLL to market the equity interests securing the junior mezzanine loan, and they will conduct a public auction after a marketing period.”

Stern’s JDS Development Group did not immediately return The Post’s request for comment.

It’s unclear what will become of the tower, which only opened to tenants last year.

The news comes just days after a 440-square-foot studio in the skyscraper sold for $905,000, making it the most expensive studio in borough history, 6sqft reported.

A video producer who lives across the street previously told The Post that the building looks like “the headquarters of an evil corporation in a superhero movie.”

The apartment, unit 72A, is more than 720 feet from the street below and features floor-to-ceiling windows, and in-unit Miele washer-dryer and European white oak flooring.

“This is an incredible milestone for Downtown Brooklyn. Our newest residents will be living at the highest elevations ever available in the borough,” said Stern, who attempted to sell part of the 1,000-foot-tall Downtown Brooklyn behemoth’s rental portion in early 2023.

At the time, he put its 398 rental apartments as well as the building’s amenities — including a pool, 50,000 square feet of retail and 77,000 square feet of workout facilities provided by the upscale chain LifeTime Fitness — on the market for an ambitious $500 million.

It’s unclear what will become of the tower, which only opened to tenants last year.

But a deal was never struck for the listing, which notably did not include the 93-story skyscraper’s 143 individual residential condominiums, and now the building’s fate is up in the air.

In addition to now having a reputation for financial trouble, the looming metallic supertall has also become known for its “evil vibes.”

A video producer who lives across the street previously told The Post that the building looks like “the headquarters of an evil corporation in a superhero movie.”