Development Project at 65 Franklin Street Has Been Sold by HAP Investments

By Manhattan Real Estate Tracker, February 16, 2025

The lot for a delayed residential development in Tribeca has been sold by HAP Investments to the Rabsky Group for $58M.

By Manhattan Real Estate Tracker, February 16, 2025

The lot for a delayed residential development in Tribeca has been sold by HAP Investments to the Rabsky Group for $58M.

By Manhattan Real Estate Tracker, December 23, 2024

Party City to Close All Stores

Manhattan Real Estate Tracker has learned that 40-year-old party store retailer Party City will be closing all of its stores in the next few months. Party City operates two stores in Manhattan and eight stores in the five boroughs. Several stores in New Jersey will be closing by the end of February.

Barry Litwin, the company CEO said that the company was hurt by stubbornly high inflation that sent costs soaring and deterred consumers from spending. “It’s really important for you to know that we’ve done everything possible that we could to try to avoid this outcome,” Litwin said. Unfortunately, it’s necessary to commence a wind-down process immediately.”

(Google)

By Manhattan Real Estate Tracker, December 23, 2024

The Container Store Files for Chapter 11 Bankruptcy

Manhattan Real Estate Tracker has learned that the Container Store has filed for Chapter 11 bankruptcy protection. The store at one time had more than 1400 locations and now is down to about 100 locations. There is one store in Manhattan at 629 Sixth Avenue near the Flatiron Building.

The 1970s-founded store of organizing and storage solutions, The Container Store, has declared bankruptcy as a result of growing losses and cash flow issues. At the same time as demand for its products is being strained in a challenging housing market, where skyrocketing prices and high mortgage rates have slowed sales, the Texas company has seen an increase in competition from retailers such as Target and Walmart. The stores will continue to operate as it restructures.

Photo of the Container Store at 629 Sixth Avenue (Google)

By Manhattan Real Estate Tracker, December 18, 2024

FARE Act Passed by New York City Council

The FARE Act, also known as Introduction 360-A, became law on December 14, 2024. Mayor Adams did not sign the law. The new rule forbids landlords from charging potential tenants the fees of brokers they engage, and it will go into force 180 days after it is passed.

The full press release by the City Council can be found here.

Heating and Hot Water Requirements for Apartments in the Five Boroughs of New York City

By Manhattan Real Estate Tracker, November 13, 2024

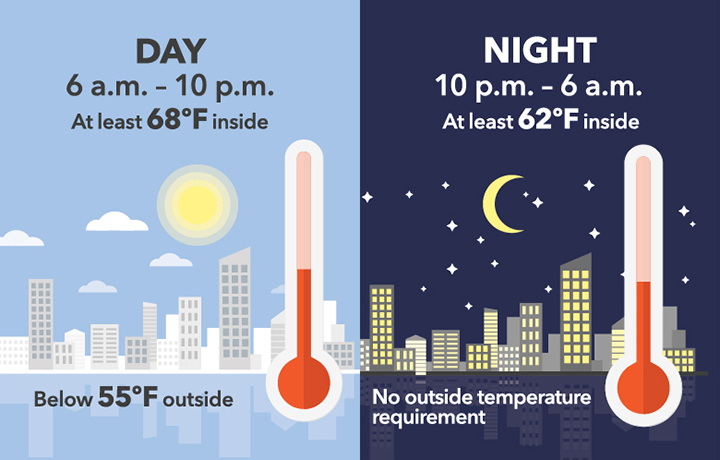

Residential tenants are legally entitled to hot water and heat from building owners. A consistent minimum temperature of 120 degrees Fahrenheit must be maintained for hot water throughout the year. During the “Heat Season,” which runs from October 1 to May 31st, heat must be supplied under the following circumstances:

Day

If the outdoor temperature drops below 55 degrees between the hours of 6:00 am and 10:00 pm, the interior temperature must be at least 68 degrees Fahrenheit.

At night

The inside temperature must be at least 62 degrees Fahrenheit between 10:00 p.m. and 6:00 a.m.

From NYCHPD

Ares Management to Acquire a Large Hell’s Kitchen Residential Building

By Manhattan Real Estate Tracker, November 12, 2024

The majority (75%) of 525 West 52nd Street will be purchased by Ares Management. The deal was structured to incorporate an assumed $200 million loan at a below-market rate. This building was designed by Handel Architects. According to the building’s website, the apartments include state-of-the-art appliances, including in-home Bosch washers and dryers, high ceilings, and rooms are framed by oversized windows showcasing city and river views. Current availabilities range from approximately $3600 for a studio to $8000 for a two bedroom. It’s great living in Hell’s Kitchen.

By Manhattan Real Estate Tracker, July 26, 2024

Photo: Crains New York Business

Trader Joes is coming to Harlem at 123 West 125th Street. This will be their first store in Harlem. The store is 18,000 sq. ft. in size and the company said that over 100 employees will be hired. The 125th Street corridor has transformed over the past 10 years into an amazing blend of local and national retail stores and restaurants. Neighbors to this new store include Whole Foods, Marshall’s, Old Navy, Shake Shack, McDonald’s, Bath and Body Works, Chipotle, Wingstop and Checkers.

Trader Joe’s was founded in California in 1967 and has grown to 571 stores nationwide. There are now 10 stores in Manhattan.

By Manhattan Real Estate Tracker, July 2, 2024

The lottery for a newly constructed 19-story building at 339 West 38th Street is open until August 19, 2024. The Department of Housing Preservation and Development states that the apartments in this building have washers and dryers. There is also a lounge, outdoor terrace, fitness center, ping pong center, bike storage, tenant storage, and conference center in the building. The building will also have a 24-hour lobby attendant and two package rooms. Tenants will pay for electricity including electric cooking and heating, the rent includes hot water. The eligible household income range is $31,612 to $218,010. More information can be found at the HPD website at Lottery Details -Housing Connect (nyc.gov)

Photos of 339 West 38th Street from HPD

By Manhattan Real Estate Tracker, June 27, 2024

Manhattan Real Estate Tracker has learned that the financially troubled American Strategic Investment Company (ASIC) has entered into a contract to sell the building at 9 Times Square for $63.5 million. The company will be taking a huge loss on the sale price since according to company records, the property was purchased for $162,291,000 prior to 2015 – a loss of more than $98 million. Formerly New York City Reit trading under the NYC symbol, the company changed the name to American Strategic Investment Company in an effort to purchase property outside of the city. This REIT has been a disaster for investors who have lost a huge amount of their initial investment. The stock went public 2021 and has dropped approximately 90% in value. After paying off the loan, the sale is expected to net only $13.5 million which the company claims will be used to buy other properties outside of Manhattan. The sale price of 9 Times Square reflects how the Midtown office market has plunged since the pandemic resulted in many employees working remotely.

Manhattan Real Estate Tracker spoke with a couple of law firms this week who have shuttered their Manhattan offices giving back large chunks of space to the landlord. Some companies have most of their employees working remotely with only a receptionist and a few conference rooms to meet with clients. Other law firms outside the city in New Jersey and Long Island have also closed offices and are working remotely. The same business model change has also occurred in the insurance industry with many adjusters now working from home.

Michael Anderson, the Chief Executive Officer of ASIC stated, “We expect this sale to generate approximately $13.5 million in net proceeds at closing, which we intend to use to pursue the expanded asset acquisition and diversification strategy into higher yielding assets that was announced last year. Additionally, if completed, we expect that this strategic disposition will strengthen our balance sheet.”

More information on the sale of 9 Times Square can be found on the ASIC website.

From: Yimby

Image from Google.com.

BY: VANESSA LONDONO 6:30 AM ON SEPTEMBER 24, 2022

Permits have been filed for an 11-story mixed-use building at 489 Ninth Avenue in Manhattan’s Midtown West. Located between West 37th and West 38th Streets, the lot is four blocks from 34th Street-Penn Station subway station, serviced by the A, C, and E trains. Susan Wu of ZD Jasper Realty is listed as the owner behind the applications.

The proposed 120-foot-tall development will yield 63,264 square feet, with 57,250 square feet designated for residential space and 6,013 square feet for commercial space. The building will have 59 residences, most likely condos based on the average unit scope of 970 square feet. The concrete-based structure will also have a cellar and a 30-foot-long rear yard.

Archimaera Architecture is listed as the architect of record.

Demolition permits will likely not be needed as the lot is vacant. An estimated completion date has not been announced.