From the Gothamist

Lead pipes may carry water to as many as 900,000 New York City homes, more than 60 years after such pipes were banned across the five boroughs, according to a new report by the New York City Coalition to End Lead Poisoning.

By analyzing publicly available data from the city’s Department of Environmental Protection, the report found that nearly half of all buildings in Brooklyn and Manhattan are served by pipes that are either certainly or potentially made of lead, a dangerous heavy metal that can cause permanent brain damage and other developmental problems in children if consumed. Staten Island’s Port Richmond had the highest proportion among individual neighborhoods.

The pipes need to be replaced for the health of the public, said Joan Matthews, senior attorney with the Natural Resources Defense Council, which contributed to the report. That’s why she and the report’s other authors want the City Council to pass a bill mandating that city agencies replace the lead pipes within the next decade.

Why lead pipes remain in NYC

- Lead is a dangerous heavy metal that can cause permanent brain damage in children.

- New York City’s water supply is lead-free, but it can become contaminated in the service lines that lead from water mains to people’s homes. About 40% of city service lines are believed to contain lead.

- You can check the status of your pipes on the Department of Environmental Protection’s Water Connection Information map.

- If your home has a lead or possible lead service line, follow the Department of Environmental Protection’s guidelines for reducing exposure. You can also follow that link to request a free test kit.

New York City treats its water to prevent corrosion, the chemical reaction by which lead flakes off the pipes and into the water supply, according to the Department of Environmental Protection. “While we agree that privately-owned lead service lines should be removed, and are actively working to do that, NYC’s daily water supply is safe,” DEP Commissioner Rohit Aggarwala said via an emailed statement.

But lead levels can still spike depending on the temperature of the water and the time since it was last turned on. Nearly a decade ago, Flint, Michigan experienced a lead crisis after merely switching what water source went through its pipes.

New York City outlawed new installations of lead service lines — the pipes that carry water from central mains to individual buildings — in 1961. But many of the predating lead service lines are still underground, and because so much time has passed, it’s unclear exactly how many remain.

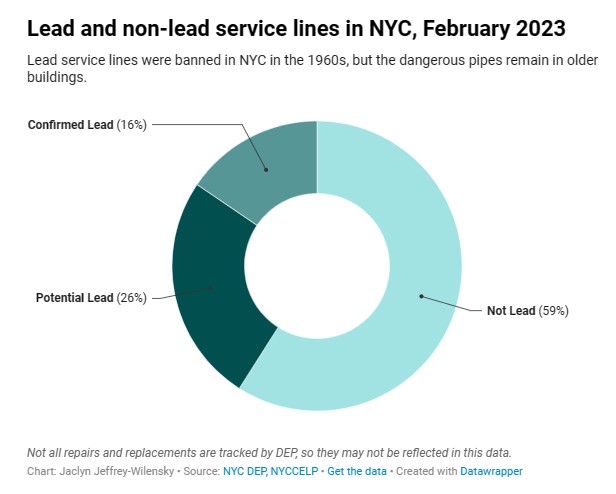

For the new report, the data team for the NYC Coalition to End Lead Poisoning — a group of experts and advocates that’s been campaigning for the cause since the 1980s — studied lead service line records published biannually by the Department of Environmental Protection. The city agency identifies confirmed lead service lines throughout the five boroughs. It also labels a pipe “potential lead” if historical records indicate that at least a portion of the water service line is lead. But it’s hard to know for sure because the pipes were installed so long ago.

The report’s authors classified the number of each service line by neighborhood and joined the counts with population data to estimate how many New Yorkers use the poisonous pipes.

The report found about 40% of citywide service lines include some lead pipe. Those service lines provide water to an estimated 1.8 million people, or more than 20% of the city’s population.

Brooklyn and Manhattan led the city in the estimated proportion of lead service lines, at 46% and 44%, respectively. The Bronx, meanwhile, had the largest chunk of confirmed lead service lines of all the boroughs.

Staten Island had a below-average proportion of lead service lines at the borough level, but its Port Richmond neighborhood, situated on its North Shore, had the largest share by far of lead service lines: an estimated 61% of its pipes are either believed or confirmed to contain lead. East Harlem, Coney Island in Brooklyn and Jamaica in Queens also ranked high on the list of neighborhoods most plagued by lead service lines.